Legal Update

Jun 1, 2020

Main Street Lending Program Update: Federal Reserve Bank of Boston Releases Form Agreements, Instructions, and Updated FAQs in Advance of Program Launch

Sign Up for our COVID-19 Mailing List.

Visit our Beyond COVID-19 Resource Center.

On May 27, 2020, the Federal Reserve Bank of Boston issued a trove of additional details, instructions and documentation for borrowers and lenders regarding the Federal Reserve Board’s (the “Fed”) Main Street Lending Program (the “Main Street Program”), including an updated Frequently Asked Questions document (the “Main Street FAQs”), form borrower and lender certifications, a form loan participation agreement and other form agreements and legal documents (collectively, the “May 27 Guidance”) to be used to implement the Main Street Program in accordance with the Main Street Program term sheets released by the Fed on April 30, 2020. The Main Street Program, the terms of which were originally announced by the Fed on April 9, 2020, and updated on April 30, 2020, was established to purchase up to $600 billion in loans from eligible lenders using funds appropriated to the Fed under the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) to support lending to small and medium-sized businesses impacted by the coronavirus disease 2019 (“COVID-19”) pandemic.

This Legal Update summarizes the details of (and key recent revisions to) the Main Street Program based on Fed instruction through the May 27 Guidance.

Borrower Eligibility

As previously announced, businesses created or organized in the US or under US laws prior to March 13, 2020 that were in good financial standing before the COVID-19 crisis are eligible to obtain a Main Street loan if (together with their affiliates) they have either (i) no more than 15,000 employees or (ii) 2019 annual revenues of less than $5 billion. In calculating the number of employees, borrowers must count their and their applicable affiliates’ full-time, part-time, seasonal and other employees and are to exclude volunteers and independent contractors. As specified in the Main Street FAQs, borrowers are to use the average of the total persons employed for each pay period over the 12 months prior to the origination of the Main Street loan. 2019 annual revenues can be calculated either using the borrower’s and its applicable affiliates’ annual “revenues” per 2019 GAAP audited financials or the borrower’s and its applicable affiliates’ receipts[1] for fiscal year 2019 as reported to the Internal Revenue Service. If the borrower (or its affiliate) does not have audited financial statements or annual receipts for 2019, the borrower should use the most recent audited financial statements or annual receipts available.

Eligible borrowers also must have significant operations, and a majority of employees based, in the US. The May 27 Guidance specifies that in order to determine if an eligible borrower has “significant operations” and a “majority of employees” in the US, the business’s operations should be evaluated on a consolidated basis together with its subsidiaries, but not its parent companies or sister affiliates. For example, an eligible borrower has significant operations in the US if, when consolidated with its subsidiaries, greater than 50% of the eligible borrower’s assets are located in the US; annual net income is generated in the US; annual net operating revenues are generated in the US; or annual consolidated operating expenses (excluding interest expense and any other expenses associated with debt service) are generated in the US. The May 27 Guidance notes that the foregoing is a non-exhaustive list of examples that reflects the principles that should be applied by a potential borrower when evaluating its eligibility under this criterion.

As noted in the May 27 Guidance, an eligible borrower may be a US subsidiary of a foreign company that has, on a consolidated basis, significant operations, and a majority of its employees based, in the US. However, a borrower that is a subsidiary of a foreign company must use the proceeds of a Main Street Loan only for the benefit of itself, its consolidated US subsidiaries, and other affiliates of the borrower that are US businesses. The proceeds of a Main Street Loan may not be used for the benefit of an eligible borrower’s foreign parents, affiliates or subsidiaries.

Borrowers also must not be an Ineligible Business listed in 13 CFR 120.110 (b)-(j), (m)-(s), as modified and clarified on or before April 24, 2020 by Small Business Administration (“SBA”) regulations for purposes of the Paycheck Protection Program, created under Title I of the CARES Act to provide aid to small businesses (“PPP”). Such Ineligible Businesses include, among others, hedge funds, private equity funds,[2] banks, life insurance companies, passive real estate investment companies and most government-owned entities. Businesses, such as airline carriers, that received support pursuant to Section 4003(b)(1)-(3) of the CARES Act, likewise are ineligible to participate in the Main Street Program.

In addition, companies that have taken advantage of the PPP may obtain both a PPP loan and a Main Street loan. However, businesses (and their affiliated companies) will only be eligible under the Main Street Program to obtain one of the Main Street loans and must not also participate in the Fed’s Primary Market Corporate Credit Facility (PMCCF), which will purchase corporate bonds from eligible issuers. In the May 27 Guidance, the Fed provided additional details around this restriction, as well as supplemental information regarding the previously announced applicability of the SBA affiliation rules.[3] Specifically:

- If any affiliate of the business has participated in the PMCCF, the business may not borrow under the Main Street Program.

- If an affiliate has previously participated, or has a pending application to participate, in the Main Street Program, the business can only participate in the Main Street Program by choosing the same Main Street loan accessed by its affiliate. For example, if an eligible borrower’s affiliate has a New Loan, then the borrower would only be able to obtain a New Loan and would be prohibited from obtaining a Priority Loan or an Expanded Loan.

- In no case may the affiliated group’s total participation in a single Main Street facility exceed the maximum loan size that the affiliated group is eligible to receive on a consolidated basis. As a result, an eligible borrower’s maximum loan size would be limited by its own leverage level, the leverage level of the affiliated group on a consolidated basis, and the size of any loan extended to other affiliates in the group. For example, in the case of a New Loan, the eligible borrower’s maximum loan size would be the lesser of:

- $25 million (less any amount extended to an affiliate of the eligible borrower under the New Loan);

- an amount that, when added to the eligible borrower’s existing outstanding and undrawn available debt, does not exceed four times the eligible borrower’s adjusted 2019 earnings before interest, taxes, depreciation and amortization (“EBITDA”); or

- an amount that, when added to the eligible borrower’s affiliated group’s existing outstanding and undrawn available debt, does not exceed four times the affiliated group’s adjusted 2019 EBITDA.

The Main Street Program is designed to be accessible to much larger businesses, and while SBA affiliation rules will apply to Main Street loans as noted above, a number of businesses (including, in some cases, private equity- and venture capital-owned firms) that were ineligible for PPP loans should be able to participate in the Main Street Program, provided they satisfy other eligibility requirements. Additionally, much of the real estate industry should be able to participate in the Main Street Program.

Non-profit entities continue to be ineligible for Main Street loans. The Fed, however, has acknowledged the unique needs of non-profit organizations and has indicated that the Fed and the Treasury Department will be evaluating the feasibility of adjusting the borrower eligibility criteria and loan eligibility metrics of the Main Street Program for non-profit entities.

Key Terms

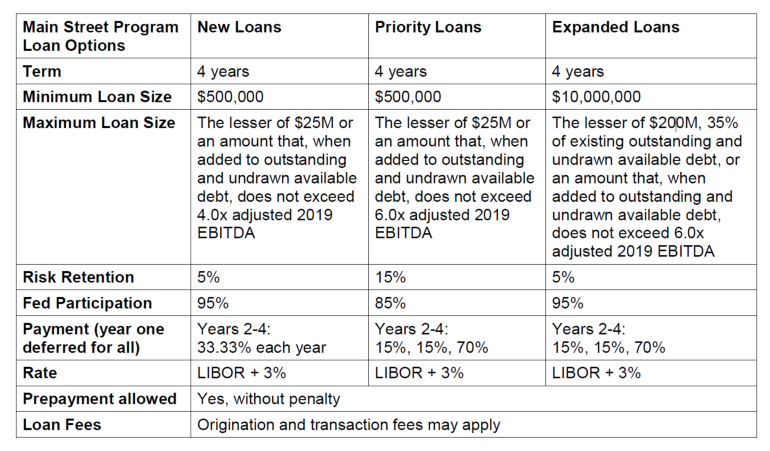

As previously announced, the Main Street Program includes three types of loans, which share a number of features, including the eligibility criteria for borrowers and lenders, maturity, interest rate, deferral of principal and interest for one year, and ability of the borrower to prepay without penalty, but have other differences, including with respect to the level of pre-crisis indebtedness an eligible borrower may have incurred. The following key terms of the loans remain as originally publicized on April 30, 2020.

New Loans

Loan sizes for new Main Street loans (i.e., those originated on or after April 24, 2020) (“New Loans”) will range from a minimum principal amount of $500,000 up to a maximum principal amount that is the lesser of (i) $25 million or (ii) an amount that, when added to the borrower’s existing outstanding and undrawn available debt, is less than or equal to four times the borrower’s 2019 adjusted EBITDA. The term of New Loans will be 4 years, with principal amortization of one-third at the end of the second, third and fourth year. New Loans may not be, at the time of origination and during the term of the loan, junior in priority in bankruptcy[4] to the borrower’s other unsecured loans or debt instruments.

Priority Loans

Loan sizes for new Main Street priority loans (i.e., those originated on or after April 24, 2020) (“Priority Loans”) will range from a minimum principal amount of $500,000 up to a maximum principal amount that is the lesser of (i) $25 million or (ii) an amount that, when added to the borrower’s existing outstanding and undrawn available debt, is less than or equal to six times the borrower’s adjusted 2019 EBITDA. The term of Priority Loans will be 4 years, with principal amortization of 15% at the end of the second and third year, and a balloon payment of 70% at the end of the fourth year. At the time of origination and at all times while the loan is outstanding, a Priority Loan must be senior to or pari passu with, in terms of priority and security,[5] the borrower’s other loans or debt instruments, other than mortgage debt.

The borrower may, at the time of origination of a Priority Loan, refinance existing debt owed by the borrower to a lender that is not the eligible lender under the Main Street Program. After origination and until the Priority Loan is repaid in full, however, the borrower must refrain from repaying the principal balance of, or paying any interest on, any debt other than the Priority Loan, unless the debt or interest payment is mandatory and due, as described in more detail below.

Expanded Loans

The maximum size for the upsized tranche of any existing loans (i.e., those originated before April 24, 2020) (the upsized tranche of such loans, “Expanded Loans”) will range from a minimum principal amount of $10 million up to a maximum principal amount that is the lesser of (i) $200 million, (ii) 35% of the borrower’s existing outstanding and undrawn available debt that is pari passu in priority with the loan and equivalent in secured status (i.e., secured or unsecured)[6] or (iii) an amount that, when added to the borrower’s existing outstanding and undrawn available debt, is less than or equal to six times the borrower’s adjusted 2019 EBITDA.

To be eligible for “upsizing,” the existing term loan or revolving credit facility must have been originated on or before April 24, 2020, and must have a remaining maturity of at least 18 months. The lender may extend the maturity of an existing loan or revolving credit facility at the time of upsizing in order for the underlying instrument to satisfy the 18-month remaining maturity requirement. At the time of upsizing and at all times thereafter, the Expanded Loan must be senior to or pari passu with, in terms of priority and security, the borrower’s other loans or debt instruments, other than mortgage debt.[7] The term of the Expanded Loan will be 4 years, with principal amortization of 15% at the end of the second and third year, and a balloon payment of 70% at the end of the fourth year.

As noted in the May 27 guidance, the lender of the Expanded Loan is not required to have been the lender that originally extended the loan underlying an Expanded Loan. However, the lender must have purchased the interest in the underlying loan as of December 31, 2019, and the lender must have assigned an internal risk rating to the underlying loan equivalent to a “pass” in the FFIEC’s supervisory rating system as of that date.

If the existing term loan is a multi-lender facility that does not have an “opening” or “accordion” clause, it can still be eligible for upsizing as an Expanded Loan if the borrower, eligible lender(s) and any other required parties amend the underlying credit agreements to comply with the requirements set out in the Expanded Loan term sheet.

Per the May 27 Guidance, the lender cannot share its 5 percent retention of an Expanded Loan with other members of a multi-lender facility and must retain 5% of the Expanded Loan.

The Fed has explained that Expanded Loans have a minimum loan size of $10 million rather than the $500,000 minimum of New Loans and Priority Loans, because Expanded Loans were designed to meet the needs of borrowers with existing loan arrangements, particularly those with larger and more complex existing loans, where pre-existing loan documentation can be used.

Other Terms

All Main Street loans are term loans (no revolving loans are available at this time), may be prepaid without penalty and will be subject to an adjustable interest rate of 1- or 3- month LIBOR + 3%. The May 27 Guidance expressly prohibits the application of any other interest rate. Amortization on Main Street loans will be deferred for one year and no payments of principal or interest will be due during this period. Unpaid interest will be capitalized.

New Loans and Priority Loans may be secured or unsecured. An Expanded Loan must be secured if the underlying loan is secured. In such case, any collateral securing the underlying loan (at the time of upsizing or on any subsequent date) must secure the Expanded Loan on a pari passu[8] basis, and, if the borrower defaults, the Main Street Program and lender(s) would share equally in any collateral available to support the loan relative to their proportional interests in the loan. The lenders can require borrowers to pledge additional collateral to secure an Expanded Loan as a condition of approval.

In the May 27 Guidance, the Fed clarified that, for New Loans and Priority Loans, the methodology the lender requires an eligible borrower to use when calculating the borrower’s adjusted 2019 EBITDA must be a methodology such lender previously required to be used for adjusting EBITDA when extending credit to the applicable borrower or similarly situated borrowers (i.e., borrowers in similar industries with comparable risk and size characteristics) on or before April 24, 2020. For Expanded Loans, the methodology a lender requires an eligible borrower to use when calculating the borrower’s adjusted 2019 EBITDA must be the methodology the lender previously required to be used for adjusting EBITDA when originating or amending the underlying loan on or before April 24, 2020. If a lender has used a range of EBITDA adjustment methods in the past, the lender should choose the most conservative method and, in any event, must select a single method used in the recent past before April 24, 2020. The lender may not “cherry pick” or apply adjustments used at different points in time or for a range of purposes. Additionally, the lender should document the rationale for its selection of an adjusted EBITDA methodology and should likewise document its process for identifying “similarly situated borrowers”.

Additionally, if a borrower’s existing debt arrangements require prepayment of an amount that is not de minimis upon the incurrence of new debt, the borrower cannot receive a New Loan or an Expanded Loan unless such requirement is waived or reduced to a de minimis amount by the relevant creditor.

Unlike the popular PPP program, Main Street loans will not be eligible for loan forgiveness. However, as noted in the May 27 Guidance, in the event of restructurings or workouts, the Fed may agree to reductions in interest (including capitalized interest), extended amortization schedules and maturities, and higher priority “priming” loans.

Borrowers of New Loans and Priority Loans will pay an origination fee to the lender of 1% of the principal amount of the applicable loan. Borrowers of the Expanded Loans will pay an “upsizing” fee to the lender of 0.75% of the principal amount of the Expanded Loan. Additionally, the lenders will be required to pay the Main Street Program a transaction fee of 1% of the principal amount of any New Loan or Priority Loan, or 0.75% of the principal amount of the Expanded Loan, at the time of origination or upsizing, as applicable, and may elect to pass this fee on to the borrower. The May 27 Guidance instructs that lenders are not permitted to charge borrowers any additional fees, except de minimis fees for services that are customary and necessary in the lender’s underwriting of commercial and industrial loans to similar borrowers, such as appraisal and legal fees. Lenders should not charge servicing fees to borrowers.

The Main Street Program will cease participations on September 30, 2020 unless extended by the Treasury Department and the Fed.

Certifications and Covenants

Various borrower and lender certifications and covenants will be required in connection with each Main Street loan. The May 27 Guidance includes several standalone documents containing detailed instructions and guidance for borrower and lender certifications and covenants.

Borrower Certifications and Covenants

Borrowers must provide the required certifications and covenants in a writing executed on behalf of the borrower by its principal executive officer and principal financial officer or functional equivalents.

As noted, the May 27 Guidance provides additional details for the borrower to take into account in determining whether the previously announced certifications (identified below) can be made.

1. The borrower will not use the proceeds of the loan to repay principal or interest on any other debt (other than mandatory principal or interest payments that are due, or, in the case of Priority Loans, debt owed to a lender other than the Priority Loan lender refinanced at the time of the origination of the loan) until the Main Street loan is fully repaid.

Per the May 27 Guidance, under the Main Street Program, borrowers may continue to pay, and lenders may request that borrowers pay, interest or principal payments on outstanding debt on (or after) the payment due date, provided that the payment due date was scheduled prior to April 24, 2020. Borrowers may not pay, and lenders may not request that borrowers pay, interest or principal payments on such debt ahead of schedule during the life of the Main Street loan, unless required by a mandatory prepayment clause as specifically permitted above. For future debt incurred by the borrower in compliance with the terms and conditions of the Main Street loan, principal and interest payments are “mandatory and due” on their scheduled dates or upon the occurrence of an event that automatically triggers mandatory prepayments.

2. The borrower will not seek to cancel or reduce any of its committed lines of credit.[9]

3. The borrower is unable to secure adequate credit accommodations from other banking institutions.

Per the May 27 Guidance, being unable to secure adequate credit accommodations does not mean that no credit from other sources is available to the borrower. Rather, the borrower may certify that it is unable to secure “adequate credit accommodations” because the amount, price, or terms of credit available from other sources are inadequate for the borrower’s needs during the current unusual and exigent circumstances. Borrowers are not required to demonstrate that applications for credit had been denied by other lenders or otherwise document that the amount, price, or terms of credit available elsewhere are inadequate.

4. The borrower has a reasonable basis to believe that, as of the date of origination or upsizing, as applicable, and after giving effect to such loan, it has the ability to meet its financial obligations for at least the next 90 days and does not expect to file for bankruptcy during that time period.

5. The borrower is not Insolvent as that term is used in 12 CFR 201.4(d)(5)(iii).

Per the May 27 Guidance, a borrower would not be Insolvent or generally failing to pay its undisputed debts as they become due because of reduced business activity resulting from stay-at-home, shelter-in-place, social distancing, or other similar orders or recommendations by government authorities related to the COVID-19 pandemic, or if expected and routine sources of funding were unexpectedly unavailable because of market conditions resulting from the COVID-19 pandemic. However, a person or entity failing to pay undisputed debts as they become due for reasons unrelated to COVID-19 would be Insolvent.

6. The borrower (i) has provided financial records to the lender and a calculation of the borrower’s (and affiliates’) adjusted 2019 EBITDA, reflecting only permitted adjustments and (ii) such financial records fairly present, in all material respects, the financial condition of such entities for the period covered thereby in accordance with GAAP, consistently applied, and such calculations are true and correct in all material respects.

7. The borrower must make certifications as to its other debt amounts and with respect to its other debt obligations’ compliance with the Main Street Program requirements concerning priority and security, as described in more detail in the form of borrower certifications and covenants included in the May 27 Guidance.

8. The borrower will follow compensation, stock repurchase, and capital distribution restrictions that apply to direct loan programs under section 4003(c)(3)(A)(ii) of the CARES Act (with certain modifications introduced by the Fed, including that an S corporation or other tax pass-through entity that is a borrower may make distributions in respect of its common stock equivalents to the extent reasonably required to cover its owners’ tax obligations in respect of the entity’s earnings), i.e.

a. Compensation restrictions:

i. For officers and employees whose total compensation exceeded $425,000 (but was less than $3 million) in 2019 or, if applicable, a subsequent reference period (as described below), borrowers may not, beginning the year of the loan and continuing for the one-year period following the satisfaction of the loan, pay such officer or employee during any 12 consecutive month period more compensation than that officer or employee received in 2019 or the subsequent reference period or pay severance/other benefits upon termination of employment with the borrower that exceed twice the maximum total compensation in 2019 or the subsequent reference period. The May 27 Guidance specifies that these restrictions do not apply to any employee whose compensation is determined through an existing collective bargaining agreement entered into prior to March 1, 2020.

ii. For officers and employees whose total compensation exceeded $3 million in 2019 or the subsequent reference period, borrowers may not, beginning the year of any loan and continuing for the one-year period following the satisfaction of the loan, pay such officer or employee during any consecutive 12 month period more than $3 million plus 50% of the amount over $3 million received by the officer in 2019 or the subsequent reference period or, except for an employee whose compensation is determined through an existing collective bargaining agreement entered into prior to March 1, 2020, pay severance pay/other benefits upon termination of employment with the borrower that exceed twice the maximum total compensation in 2019 or the subsequent reference period.

The May 27 Guidance introduces restrictions applicable to new hires and existing officers or employees who become highly compensated. Specifically, for an officer or employee whose employment with a borrower started during 2019 or later, the “subsequent reference period” is the 12-month period starting from the end of the month in which the individual began employment, if his or her total compensation exceeds $425,000 during such period. For an officer or employee whose total compensation first exceeds $425,000 during a 12-month period ending after 2019, the “subsequent reference period” is the 12-month period starting from the end of the month in which his or her total compensation first exceeded $425,000.

The May 27 Guidance also instructs that “officers or employees” mean individuals who perform compensated services for a borrower and either (a) for whom, in connection with those services, the borrower would be responsible for reporting the compensation on Form W-2 and withholding federal income taxes (regardless of whether the compensation is subject to withholding or tax is withheld) or (b) is a partner in a partnership, member of a limited liability company or similar. Independent contractors and independent directors are not considered officers or employees.

“Total compensation” includes salary, bonuses, awards of stock and other financial benefits provided by the borrower and its affiliates to an officer or employee of the borrower.

b. Stock repurchase/capital distributions prohibitions: Borrowers with direct loans cannot, absent a waiver from the Fed, engage in stock buybacks, unless required under pre-existing contracts in effect as of March 27, 2020, or pay dividends or make other capital distributions with respect to the common stock equivalents of the borrower, until one year after the date the Main Street loan is no longer outstanding, subject to the exception with respect to S-corporations or other pass-through entities.

Consistent with the CARES Act, the prohibition on stock buybacks is limited to borrowers that have, or have a parent company that has, equity securities listed on a national securities exchange.

The May 27 Guidance also instructs that dividends and other capital distributions means any payment made with respect to the borrower’s common stock equivalents, including discretionary dividend payments, and would include mandatory or preferential payments of dividends or other distributions in respect of preferred stock unless both the equity interest and the obligation to pay dividends or distributions existed as of March 27, 2020. Dividends and other capital distributions do not include repurchases or redemptions. Per the May 27 Guidance, any tax distributions made pursuant to the exception for pass-through entities shall be subject to an annual reconciliation, with any surplus or deficiency to be deducted from or added to distributions, as applicable, in the following year.

9. The borrower will use the proceeds of the loan only for the benefit of the borrower, its consolidated US subsidiaries and other affiliates of the borrower that are US businesses.

10. The borrower is eligible to participate in the Main Street Program, including by meeting all eligibility criteria described above and in light of the conflicts of interest prohibition in section 4019(b) of the CARES Act (“Conflicts of Interest Prohibition”)—i.e., Businesses in which the President, Vice President, an executive department head, Member of Congress—or such individual’s spouse, child (including adult children), son-in-law, or daughter-in-law (each a “covered individual”)—own, control or hold at least a 20% direct or indirect equity stake (by vote or value) of the outstanding amount of any class of equity interest will not be eligible for emergency relief funds under Title IV of the CARES Act, including Main Street Program funds.

As detailed in the May 27 Guidance, for purposes of the Conflicts of Interest Prohibition, a covered individual’s indirect equity interest by value shall be calculated on a proportional basis, taking into account any partial ownership of the relevant entity’s parents. A share is considered an ownership interest without regard to whether it is transferable or classified as stock or anything similar and without regard to whether it is a voting security. Warrants, options and similar rights must be counted even if they are unexercised or “out of the money”. The May 27 Guidance provides instructions for the diligence required to determine whether the Conflicts of Interest Prohibition is triggered. Specifically, the borrower is responsible for any “actual knowledge” of the borrower and is required to determine the beneficial owner of any 5 percent or greater equity interest of the entity and whether such beneficial owner is a covered individual by checking the name against a list of government officials provided in the May 27 Guidance and by asking each such beneficial owner whether the owner is a covered individual. To determine the identify of beneficial owners of publicly traded securities, borrowers are entitled to rely on information disclosed in Securities Exchange Act sections 13(d) and 13(g) filings.

The certifications and covenants also include an indemnification by the borrower of the beneficiaries of such certifications and covenants in respect of losses arising out of a material breach of any certifications or covenants.

The requirements that the borrower certify that (i) it requires financing due to the exigent circumstances presented by COVID-19 and (ii) it will make reasonable efforts to maintain its payroll and retain its employees during the term of the loan were deleted in the April 30, 2020 versions of the Main Street Program term sheets and remain absent in the May 27 Guidance. The Fed indicated that each borrower that participates in the Main Street Program should make commercially reasonable efforts to maintain its payroll and retain its employees during the term of the loan. As announced in the Main Street FAQs on April 30, 2020, a borrower should undertake good-faith efforts to maintain payroll and retain employees, in light of its capacities, the economic environment, its available resources, and the business need for labor. Borrowers that have already laid-off or furloughed workers as a result of the disruptions from COVID-19 remain eligible to apply for Main Street loans.

Additionally, unlike the separate Mid-Sized Businesses loan program contemplated by Section 4003(c)(3)(D) of the CARES Act (details of which have not been announced by the Fed), based on current Fed guidance (including the May 27 Guidance), there is no requirement that borrowers under the Main Street Program agree to remain neutral in union organizing efforts or to refrain from abrogating existing collective bargaining agreements.

Lender Certifications and Covenants

The certifications and covenants to be made by the lenders in connection with the issuance of the three types of Main Street Loans are generally similar, subject to the specific differences in the features of any given type of loan, with respect to which the lender must certify.

The May 27 Guidance regarding lenders’ certifications and covenants is consistent with the Fed’s April 30, 2020 instruction. Specifically, as previously announced, the lender must certify:

- The lender will not request that the proceeds of the loan be used to repay debt extended by the lender to the borrower, or any interest (other than mandatory principal or interest payments, or in the case of default or acceleration) until the Main Street loan is fully repaid.

- The lender will not cancel or reduce any existing committed lines of credit outstanding to the borrower, other than in an event of default until (i) the loan is repaid in full or (ii) neither the Main Street Program nor a governmental assignee holds an interest in the loan in any capacity.

- The methodology required to be used by the borrower for calculating the borrower’s adjusted 2019 EBITDA for the applicable loan leverage requirement is the methodology it has previously required for adjusting EBITDA when extending credit to the borrower or similarly situated borrowers (or originating or amending the underlying facility, in the case of an Expanded Loan) on or before April 24, 2020.

- The lender is eligible to participate in the Main Street Program, including in light of the Conflicts of Interest Prohibition.

In addition to various certifications, including regarding the priority and security of the loan as compared to other outstanding debt and the eligibility of a particular loan for the purposes of the Main Street Program, such as the date of origination, term and maturity date, deferral of principal and interest payments, and amortization of the principal, as specified in the lender certification forms included in the May 27 Guidance, the lender must certify and covenant that:

- Based solely on the financial information provided by the borrower and the calculation of the borrower’s adjusted 2019 EBITDA certified to the lender by the borrower, the eligible loan amount when added to the borrower’s existing and undrawn available debt does not exceed four (or six, as applicable) times the borrower’s adjusted 2019 EBITDA.

- The eligible loan is not at the time of origination, and the lender will commit that the loan will not, through any action of the lender, become, subordinated in terms of priority to any of the borrower’s other debt instruments.

- Prepayments are permitted without penalty.

The lender is also required to make certain certifications with respect to its risk retention in the Main Street loan and the borrower’s internal risk rating equivalent to “pass”. Additionally, the lender must certify that the loan documentation contains a provision triggering an event of default and permitting acceleration if the borrower has defaulted on other loans made by the lender or any of its controlled affiliates, and the lender or its controlled affiliate has accelerated the obligations in respect of such loan. Lender certifications as to lien and negative pledge covenants and financial reporting covenants are also required,

Further, each lender is required to certify, with respect to each Main Street loan, that the loan documentation contains a provision triggering a mandatory prepayment upon the lender’s receipt of notice from the Fed or its designee that the borrower has made a material misstatement with respect to its certifications or covenants regarding eligibility under the CARES Act or that such covenants have been materially breached. While the lender is not expected to monitor the borrower’s ongoing compliance with covenants set out in the borrower certifications and covenants (and has limited obligations to independently verify information certified by the borrower, as described in more detail in the May 27 Guidance), the lender must also agree that if the borrower reports a material misrepresentation under its certifications and covenants, or a material breach of its covenants, the lender will promptly report such material misrepresentation or material breach to the Fed.

Main Street Lenders

Eligible lenders under the Main Street Program are US insured depository institutions, US bank holding companies, and US savings and loan holding companies. Per the May 27 Guidance, multiple affiliated entities may register as eligible lenders under the Main Street Program.

Lenders subject to Fed restrictions on capital planning and stress testing are advised to continue referencing Fed guidance when evaluating Main Street loans for capital planning and stress testing purposes; lenders need only evaluate the retained portion of Main Street loans since the sale of participations to the Main Street Program will be structured as “true sales.”

Main Street lenders will be required to retain (until the earlier of maturity or until neither the Main Street Program nor a governmental assignee holds an interest in the Main Street Loan in any capacity), with respect to New Loans or Expanded Loans, a 5 percent share of such loan, and with respect to Priority Loans, a 15 percent share of such loan, and sell the remaining percent of the applicable loan to the Main Street Program. The Main Street Program and the applicable lenders would share in any losses on the Main Street loans on a pari passu basis. As explained in the May 27 Guidance, the higher risk retention for Priority Loans is required in light of the increased leverage ratio of Priority Loans relative to New Loans and Expanded Loans.[10]

The Main Street Program will pay eligible lenders 0.25% of the principal amount of the participation in eligible Main Street loans per annum for loan servicing.

Lenders are expected to conduct an assessment of each potential borrower’s financial condition at the time of the potential borrower’s application and should satisfy themselves with respect to a borrower’s ability to repay Main Street loans, taking into account a borrower’s credit history and financial performance prior to the COVID-19 crisis, as well as its post-pandemic business prospects. Fed supervisors will approach Main Street loans in a manner consistent with their supervisory approach to other commercial and industrial loans. The May 27 Guidance reminds lenders that appropriate risk management practices under extraordinary circumstances are outlined in SR 17-14. Further, each Main Street loan must have an internal risk rating from the lender equivalent to a “pass” in the Federal Financial Institutions Examination Council’s (FFIEC’s) supervisory rating system as of December 31, 2019.[11] The May 27 Guidance confirms that lenders should follow their normal policies and procedures for originating a loan to a new customer, including Know Your Customer procedures.

Under the Main Street Program, lenders will have two options for funding loans:

- Funded Loan: A lender may extend Main Street loan to an eligible borrower and fund such loan. Thereafter, a lender that has registered with the Main Street Program can seek to sell a participation in such loan to the Main Street Program by submitting all of the required documentation, completed and signed, for processing. Upon determining that such paperwork is complete and consistent with Main Street Program requirements, the Main Street Program would purchase a participation in such loan by dating and countersigning the Participation Agreement and returning it to the lender. Lenders using this option must submit the loan to the Main Street Program for sale of a participation interest expeditiously (i.e., no later than 14 days) after the closing of such loans.

- Condition of Funding: A lender may also extend a Main Street loan to an eligible borrower, but make the funding of the loan contingent on a binding commitment from the Main Street Program that it will purchase a participation in the loan. Under this option, the lender, if registered with the Main Street Program, would submit all of the required documentation, completed and signed, for processing, but would indicate in its submission that the loan has not yet been funded. The Main Street Program would review the required documentation and, if complete and consistent with Program requirements, would provide the lender with a binding commitment to purchase the loan after it is funded (Commitment Letter). The Commitment Letter will indicate that the lender is required to fund the loan within three business days of the date of the Commitment Letter and that the Main Street Program will purchase the participation in the loan not later than three business days after the lender notifies the Main Street Program that the lender has funded the loan. The lender will provide this notification by entering the funding date of the loan into a field in a portal for the Main Street Program. A funding notice submitted by the lender after 4 p.m. will be treated as if it were received the next business day. The May 27 Guidance includes proposed language for use in loan documentation for lenders who choose this option.

Disclosure and Reports

The Fed will disclose information regarding the Main Street loans during the operation of Main Street Program, including information regarding names of lenders and borrowers, amounts borrowed and interest rates charged, and overall costs, revenues and other fees. Under section 11(s) of the Federal Reserve Act, the Fed also will disclose information concerning the Main Street Program one year after the effective date of the termination of the authorization of the Main Street Program. This disclosure will include names and identifying details of each participant in the Main Street Program, the amount borrowed, the interest rate or discount paid, and information concerning the types and amounts of collateral pledged or assets transferred in connection with participation in the Main Street Program.

The Fed also will provide periodic reports on the size of the Main Street Program and its remaining capacity.

Documentation and Launch Date

In addition to the borrower and lender certification and covenant forms described above, the May 27 Guidance included the following form agreements and other documents for lenders and borrowers to use in connection with Main Street Loans:

- Lender Wire Instructions Direction, pursuant to which the lender provides wire instructions for the bank account into which the Main Street Program will transfer the purchase price and any other payments in respect of the Main Street Program’s purchase of a participation from the lender.

- Loan Participation Agreement (and Participation Agreement Standard Terms and Conditions), which serves as the agreement under which the Main Street Program purchases a participation in an eligible loan. The Loan Participation Agreement also sets forth when the Main Street Program can sell its loan participation or elevate its loan participation into assignment and any related required lender and/or borrower consents. Under the Loan Participation Agreement, the Main Street Program will have the option to elevate its participation to an assignment to be in privity with the borrower if the borrower misses a mandatory and due payment on the Main Street loan (beyond the applicable grace period) or the borrower or lender enters into bankruptcy or other insolvency proceedings, although the Main Street Program does not expect to use this right as a matter of course. Rather, the Main Street Program would expect lenders to follow market-standard workout processes and to exercise the same duty of care in approaching such proceedings as it would exercise if it retained a beneficial interest in the entire loan. Under the Loan Participation Agreement and Co-Lender Agreement (described below), the Main Street Program has waived and disclaimed its right to assert special administrative priority under Section 507(a)(2) of the Bankruptcy Code, citing anticipated enhancement of the efficacy of the Main Street Program and certainty for eligible lenders and borrowers, without compromising taxpayer protection.

- Co-Lender Agreement (Transaction Specific Terms and Standard Terms and Conditions), which provides the necessary agency and operational mechanics to accommodate multiple lenders in what was previously a bilateral facility. Under the Co-Lender Agreement, the lender is appointed as administrative agent with respect to the loan, effective upon the elevation (or elevation and transfer) of the loan by the Main Street Program such that there will then be multiple lenders with respect to the loan. The Co-Lender Agreement is executed in blank by the lender and the borrower.

- Servicing Agreement, which the lender must complete, sign, and submit at the time a loan participation is sold to the Fed.

- Assignment-in-Blank, which is intended to be used by the Main Street Program to elevate its participation or to elevate and transfer its participation only in the limited circumstances of a Specified Permitted Transfer (as defined in the Participation Agreement), where so permitted. In order to facilitate such Specified Permitted Transfers, the Assignment-in-Blank serves as advance consent by the lender and the borrower to any such transfer.

Information regarding the loan documentation required to sell a participation to the Main Street Program will be made available on the Federal Reserve Bank of Boston’s website.

As previously announced, the Fed will not provide form loan documents for eligible lenders to use when making eligible loans to eligible borrowers—and eligible lenders are advised that they should provide these documents. Such documentation should be substantially similar, including with respect to required covenants, to the loan documentation that the lender uses in its ordinary course lending to similarly situated borrowers, adjusted only as appropriate to reflect the terms and requirements of the Main Street Program established by the Fed.

- Appendix A to the Main Street FAQs contains a checklist of terms and covenants that must be reflected in the loan documentation in order for the Main Street Program to purchase a participation in the loan. These include borrower certification material breach-related mandatory prepayment and cross-acceleration provisions, collateral descriptions and financial reporting obligations, which are further detailed in the other appendices.

- Appendix B to the Main Street FAQs includes certain model covenants that lenders can elect to reference when drafting their loan documentation in order to satisfy the Appendix A requirements.

- Borrower Certifications and Covenants Material Breach Prepayment Provision: As noted above, each borrower must submit signed Borrower Certifications and Covenants in connection with the Main Street loan. If the Main Street Program determines that the borrower made a material misstatement in the certifications, or materially breached covenants, relating to applicable laws or regulations, the Main Street Program will notify the lender to trigger mandatory prepayment under the Main Street loan.

- Cross-Acceleration Provision: Each Main Street loan should contain a cross-acceleration provision that would trigger an event of default under the loan if a different loan extended to the borrower by the lender or lender’s commonly controlled affiliate is accelerated.

- Financial Reporting Covenant: Each Main Street loan should contain a financial reporting covenant requiring regular delivery of certain financial information and calculations, which are detailed in Appendix C.

- Appendix C to the Main Street FAQs includes a list of the financial information and reports that lenders must require eligible borrowers to provide on an ongoing basis until the Main Street loan matures. Certain financial reports are required to be delivered annually and others quarterly. The quarterly requirements vary based on the Main Street loan.

Fed Chair Jerome Powell announced on May 19, 2020 that the Main Street Program is set to begin operating by June 1, 2020, but in a webinar conducted on May 29, 2020 the Fed did not commit to that date.

Updates regarding the Main Street Program, including the official launch of the program, and the time and date at/on which the Main Street Program will begin purchasing participations in Main Street loans, will be made available on the Fed’s website.

Changes to Main Street Program and Terms

The Board of Governors of the Federal Reserve System and the Secretary of the Treasury may make adjustments to the terms and conditions of the Main Street Program and will announce any changes on the Fed’s website.[12]

Before applying for a Main Street loan, borrowers should review existing credit agreements, governing documents and other contracts to identify any restrictions on the incurrence of additional indebtedness, including any required consents.

Seyfarth is actively monitoring all aspects of federal COVID-19 business stimulus funding legislation and guidance impacting our clients. Visit our Resource Center for more information.

[1] “Receipts” has the same meaning used by the SBA in 13 CFR 121.104(a).

[2] SBA has determined that private equity funds and hedge funds are primarily engaged in investment or speculation, and that such businesses are therefore ineligible to receive PPP loans under 13 CFR 120.110(s). Portfolio companies of private equity funds, however, are not categorically excluded and are subject to the eligibility requirements imposed on other borrowers.

[3] 13 CFR 121.301(f).

[4] The Main Street FAQs detail the requirements for meeting the “not junior in priority in bankruptcy” test.

[5] The Main Street FAQs detail the requirements for meeting the “senior to or pari passu” test.

[6] The Main Street FAQs detail the requirements for meeting the “pari passu in priority with the loan and equivalent in secured status (i.e., secured or unsecured)” test.

[7] The Main Street FAQs detail the requirements for meeting the “senior to or pari passu with, in terms of priority and security” test.

[8] The Fed had previously indicated that the underlying loan must secure the Expanded Loan on a “pro rata” basis, rather than (as previously indicated) a “pari passu” basis.

[9] This and the preceding requirement will not prohibit a borrower from undertaking any of the following actions during the term of the Main Street Loan:

- repaying a line of credit (including a credit card) in accordance with the borrower’s normal course of business usage for such line of credit;

- taking on and paying additional debt obligations required in the normal course of business and on standard terms, including inventory and equipment financing, provided that such debt is secured only by the newly acquired property (e.g., inventory or equipment), and, apart from such security, is of equal or lower priority than the Main Street Loan; or

- refinancing maturing debt.

[10] Priority Loans, as compared to New Loans, permit borrowers with higher leverage to access the Main Street Program. While Expanded Loans and Priority Loans use the same adjusted EBITDA multiple of six times as a measure to limit maximum loan size, Expanded Loans also include a maximum loan size test not applicable to Priority Loans (i.e., an Expanded Loan may not exceed 35% of the borrower’s existing outstanding and undrawn available debt that is pari passu in priority with the underlying loan and equivalent in secured status). Additionally Expanded Loans share in any security associated with the underlying loan that is being upsized, a feature missing from Priority Loans.

[11] In the case of an Expanded Loan, if the existing loan was originating after December 31, 2019, the lender should use the internal risk rating given to that loan at origination to determine whether the loan is eligible for upsizing under the Main Street Program.

[12] The Fed has specifically identified that it will continue to evaluate whether the loan amounts allowed under the Main Street Program should be adjusted to enhance the Main Street Program’s efficacy and will communicate any such adjustments well in advance of their effective date to ensure that eligible lenders and borrowers are not adversely affected.