Legal Update

May 1, 2020

Money for Main Street Update: Fed Releases Revised Main Street Lending Program Guidance and Terms

Sign up for our Coronavirus roundup email.

Visit our Coronavirus resource page.

On April 30, 2020, following a period of public comment, the Federal Reserve Board (“Fed”) published additional guidance and revisions to its Main Street Lending Program (the “Main Street Program”), expanding the program’s scope and eligibility. The Main Street Program, the terms of which were originally announced by the Fed on April 9, 2020, was established to purchase up to $600 billion in loans from eligible lenders using funds appropriated to the Fed under the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) to support lending to small and medium-sized businesses impacted by the coronavirus disease 2019 (“COVID-19”) pandemic.

This Legal Update summarizes the details of the Main Street Program based on updated guidance from the Fed as of April 30, 2020.

Key Features of the New Guidance

- Creates a third and new loan option, the Priority Loan

- Lowers the minimum loan amount from $1,000,000 to $500,000 for certain loans

- Expands the pool of eligible borrowers to include businesses with up to 15,000 employees and up to $5 billion in 2019 annual revenues, compared to businesses with up to 10,000 employees and up to $2.5 billion in 2019 annual revenues in the initial Main Street Program announcement

- Clarifies that Small Business Administration (“SBA”) affiliation rules applicable to Paycheck Protection Program loans will apply in determining eligibility for the Main Street Program

- Provides that certain businesses that are ineligible for a loan under the Paycheck Protection Program are also ineligible for a loan under the Main Street Program

Borrower Eligibility

Businesses created or organized in the US or under US laws prior to March 13, 2020 that were in good financial standing before the COVID-19 crisis are eligible to obtain a Main Street loan if (together with their affiliates) they have either (i) no more than 15,000 employees or (ii) 2019 annual revenues of less than $5 billion. In calculating the number of employees, borrowers must count full-time, part-time, seasonal and other employees and are to exclude volunteers and independent contractors. 2019 annual revenues can be calculated either using annual revenues per 2019 GAAP audited financials or receipts for fiscal year 2019 as reported to the Internal Revenue Service. As previously announced by the Fed, eligible borrowers also must have significant operations in and a majority of employees based in the US.

Non-profit entities continue to be ineligible for Main Street loans. The Fed, however, acknowledged the unique needs of non-profit organizations and indicated that the Fed and the Treasury Department will be evaluating the feasibility of adjusting the borrower eligibility criteria and loan eligibility metrics of the Main Street Program for non-profit entities.

Borrowers also must not be an Ineligible Business listed in 13 CFR 120.110 (b)-(j), (m)-(s), as modified and clarified on or before April 24, 2020 by SBA regulations for purposes of the Paycheck Protection Program, created under Title I of the CARES Act to provide aid to small businesses (“PPP”). Such Ineligible Businesses include, among others, banks, life insurance companies and most government-owned entities. Businesses, such as airline carriers, that received support pursuant to Section 4003(b)(1)-(3) of the CARES Act, likewise are ineligible to participate in the Main Street Program.

In addition, companies that have taken advantage of the PPP may obtain both a PPP loan and a Main Street loan. However, businesses will only be eligible under the Main Street Lending Program to obtain one of the Main Street loans and must not also participate in the Fed’s Primary Market Corporate Credit Facility, which will purchase corporate bonds from eligible issuers.

The Main Street Program is designed to be accessible to much larger businesses, and while Small Business Administration affiliation rules1 will apply to Main Street loans for purposes of determining whether the number of employees and/or 2019 revenues of the borrower business, a number of businesses (including, in some cases, private equity- and venture capital-owned firms) that were ineligible for PPP loans should be able to participate in the Main Street Lending Program, provided they satisfy other eligibility requirements, including the leverage restrictions described below. Additionally, much of the real estate industry should be able to participate in the Main Street Lending Program.

Key Terms

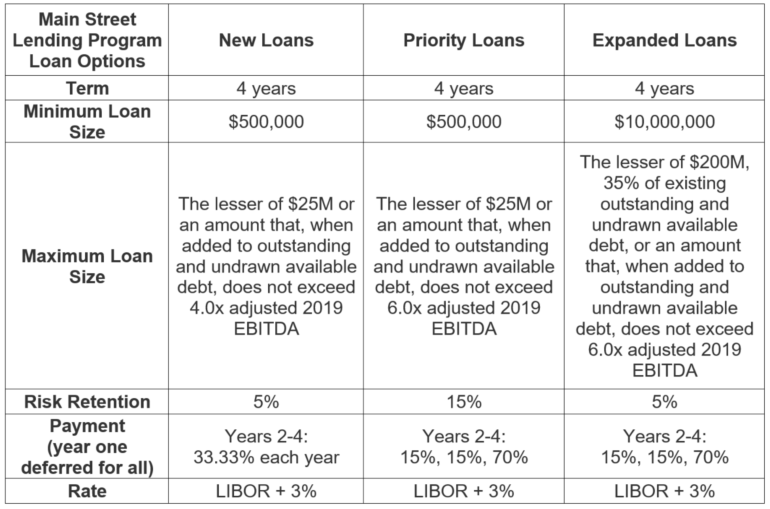

The Main Street Program includes three types of loans, which share a number of features, including the eligibility criteria for borrowers and lenders, maturity, interest rate, deferral of principal and interest for one year, and ability of the borrower to prepay without penalty, but have other differences, including with respect to the level of pre-crisis indebtedness an eligible borrower may have incurred.

New Loans

Loan sizes for new Main Street loans (i.e., those originated on or after April 24, 2020) (“New Loans”) will range from a minimum principal amount of $500,000 up to a maximum principal amount that is the lesser of (i) $25 million or (ii) an amount that, when added to the borrower’s existing outstanding and undrawn available debt, is less than or equal to four times the borrower’s 2019 adjusted earnings before interest, taxes, depreciation and amortization (“EBITDA”). The Fed clarified that the methodology used by lenders to calculate adjusted 2019 EBITDA must be the methodology such lender has previously used for adjusting EBITDA when extending credit to an applicable borrower or similarly situated borrowers on or before April 24, 2020. The term of New Loans will be 4 years, with principal amortization of one-third at the end of the second, third and fourth year. New Loans may not be, at the time of origination and during the term of the loan, junior in priority in bankruptcy to the borrower’s other unsecured loans or debt instruments.

Priority Loans

Loan sizes for new Main Street priority loans (i.e., those originated on or after April 24, 2020) (“Priority Loans”) will range from a minimum principal amount of $500,000 up to a maximum principal amount that is the lesser of (i) $25 million or (ii) an amount that, when added to the borrower’s existing outstanding and undrawn available debt, is less than or equal to six times the borrower’s adjusted 2019 EBITDA. The term of Priority Loans will be 4 years, with principal amortization of 15% at the end of the second and third year, and a balloon payment of 70% at the end of the fourth year. At the time of origination and at all times thereafter, a Priority Loan must be senior to or pari passu with, in terms of priority and security, the borrower’s other loans or debt instruments, other than mortgage debt. The borrowers may, at the time of origination of a Priority Loan, refinance existing debt owed by the borrower to a lender that is not the eligible lender under the Main Street Program.

Expanded Loans

The maximum size for the upsized tranche of any existing loans (i.e., those originated before April 24, 2020) (“Expanded Loans”) will range from a minimum principal amount of $10 million up to a maximum principal amount that is the lesser of (i) $200 million, (ii) 35% of the borrower’s existing outstanding and undrawn available debt that is pari passu in priority with the loan and equivalent in secured status (i.e., secured or unsecured) or (iii) an amount that, when added to the borrower’s existing outstanding and undrawn available debt, is less than or equal to six times the borrower’s adjusted 2019 EBITDA.

To be eligible for “upsizing,” the existing term loan or revolving credit facility must have been originated on or before April 24, 2020, and must have a remaining maturity of at least 18 months. The lender may extend the maturity of an existing loan or revolving credit facility at the time of upsizing in order for the underlying instrument to satisfy the 18-month remaining maturity requirement. At the time of upsizing and at all times thereafter, the Expanded Loan must be senior to or pari passu with, in terms of priority and security, the borrower’s other loans or debt instruments, other than mortgage debt. The term of the Expanded Loan will be 4 years, with principal amortization of 15% at the end of the second and third year, and a balloon payment of 70% at the end of the fourth year.

Other Terms

All Main Street loans may be prepaid without penalty and will be subject to an adjustable interest rate of 1- or 3- month LIBOR + 3%. Amortization on Main Street loans will be deferred for one year and no payments of principal or interest will be due during this period. Unpaid interest will be capitalized. New Loans and Priority Loans may be secured or unsecured. An Expanded Loan must be secured if the underlying loan is secured. In such case, any collateral securing the underlying loan (at the time of upsizing or on any subsequent date) must secure the Expanded Loan on a pro rata basis, and, if the borrower defaults, the Main Street Program and lender(s) would share equally in any collateral available to support the loan relative to their proportional interests in the loan. The lenders can require borrowers to pledge additional collateral to secure an Expanded Loan as a condition of approval.

Unlike the popular PPP program, Main Street loans will not be eligible for loan forgiveness.

Borrowers of New Loans and Priority Loans will pay an origination fee to the lender of 1% of the principal amount of the applicable loan. Borrowers of the Expanded Loans will pay an “upsizing” fee to the lender of 0.75% of the principal amount of the Expanded Loan. Additionally, the lenders will be required to pay the Main Street Program a transaction fee of 1% of the principal amount of any New Loan or Priority Loan, or 0.75% of the principal amount of the Expanded Loan, at the time of origination or upsizing, as applicable, and may elect to pass this fee on to the borrower.

The Main Street Program will cease participations on September 30, 2020 unless extended by the Treasury Department and the Fed.

Certifications

Various borrower and lender certifications will be required in connection with each Main Street loan, including the following:

Borrower Certifications

- The borrower will not use the proceeds of the loan to repay principal or interest on any other debt (other than mandatory principal or interest payments that are due, or, in the case of Priority Loans, debt owed to a lender other than the Priority Loan lender refinanced at the time of the origination of the loan) until the Main Street loan is fully repaid.

- The borrower will not seek to cancel or reduce any of its committed lines of credit.2

- The borrower has a reasonable basis to believe that, as of the date of origination or upsizing, as applicable, and after giving effect to such loan, it has the ability to meet its financial obligations for at least the next 90 days and does not expect to file for bankruptcy during that time period.

- The borrower will follow compensation, stock repurchase, and capital distribution restrictions that apply to direct loan programs under section 4003(c)(3)(A)(ii) of the CARES Act (except that an S corporation or other tax pass-through entity that is a borrower may make distributions to the extent reasonably required to cover its owners’ tax obligations in respect of the entity’s earnings), i.e.,

- Compensation restrictions: For officers that made over $425,000 in 2019, borrowers may not, beginning the year of the loan and continuing for the one-year period following the satisfaction of the loan, pay an officer more compensation than that officer received in 2019 or pay severance/other benefits that exceed twice the maximum total compensation in 2019. For officers that made over $3 million in 2019, borrowers may not, beginning the year of any loan and continuing for the one-year period following the satisfaction of the loan, pay an officer more than $3 million plus 50% of the amount over $3 million received by the officer in 2019.

- Stock repurchase/capital distributions prohibitions: Borrowers with direct loans cannot, absent a waiver from the Fed, engage in stock buybacks, unless required under pre-existing contracts, or pay dividends or make other capital distributions, until one year after the date the Main Street loan is no longer outstanding, subject to the exception with respect to S-corporations or other pass-through entities.

- The borrower is eligible to participate in the Main Street Lending Program, including in light of the conflicts of interest prohibition in section 4019(b) of the CARES Act (“Conflicts of Interest Prohibition”)—i.e., Businesses in which the President, Vice President, an executive department head, Member of Congress—or such individual’s spouse, child (including adult children), son-in-law, or daughter-in-law—own at least a 20% direct or indirect equity stake will not be eligible for emergency relief funds under Title IV of the CARES Act, including Main Street Lending Program funds.

Note that the requirements that the borrower certify that (i) it requires financing due to the exigent circumstances presented by COVID-19, (ii) it will make reasonable efforts to maintain its payroll and retain its employees during the term of the loan and (iii) the borrower meets the EBITDA leverage condition for the applicable loan were deleted in the April 30, 2020 versions of the Main Street Program term sheets. The Fed indicated that each borrower that participates in the Main Street Program should make commercially reasonable efforts to maintain its payroll and retain its employees during the term of the loan. The Fed further clarified, in its Main Street Program Frequently Asked Questions, also published on April 30, 2020, that a borrower should undertake good-faith efforts to maintain payroll and retain employees, in light of its capacities, the economic environment, its available resources, and the business need for labor. Borrowers that have already laid-off or furloughed workers as a result of the disruptions from COVID-19 remain eligible to apply for Main Street loans.

Of note, unlike the separate Mid-Sized Businesses loan program contemplated by Section 4003(c)(3)(D) of the CARES Act (details of which have not been announced by the Fed), based on current Fed guidance, there is no requirement that borrowers under the Main Street Program agree to remain neutral in union organizing efforts or to refrain from abrogating existing collective bargaining agreements.

Lender Certifications

- The lender will not request that the proceeds of the loan be used to repay debt extended by the lender to the borrower, or any interest (other than mandatory principal or interest payments, or in the case of default or acceleration) until the Main Street loan is fully repaid.

- The lender will not cancel or reduce any existing committed lines of credit outstanding to the borrower, other than in an event of default.

- The methodology used for calculating the borrower’s adjusted 2019 EBITDA for the applicable loan leverage requirement is the methodology it has previously used for adjusting EBITDA when extending credit to the borrower or similarly situated borrowers on or before April 24, 2020.

- The lender is eligible to participate in the Main Street Lending Program, including in light of the Conflicts of Interest Prohibition.

Main Street Lenders

Eligible lenders under the Main Street Lending Program are US insured depository institutions, US bank holding companies, and US savings and loan holding companies. Under the Main Street Program, lenders will be required to retain (until the earlier of maturity or until the Main Street Program sells all of its participation), with respect to New Loans or Expanded Loans, a 5 percent share of such loan, and with respect to Priority Loans, a 15 percent share of such loan, and sell the remaining percent of the applicable loan to the Main Street Program. The Main Street Program and the applicable lenders would share in any losses on the Main Street loans on a pari passu basis.

The Main Street Program will pay eligible lenders 0.25% of the principal amount of the participation in eligible Main Street loans per annum for loan servicing.

In contrast to the PPP loan program, which permits lenders to rely on borrower certifications as to program eligibility, Main Street program lenders are expected to conduct an assessment of each potential borrower’s financial condition at the time of the potential borrower’s application and to apply their own underwriting standards in evaluating the financial condition and creditworthiness of a potential borrower. Lenders may require additional information and documentation in making this evaluation. Lenders will ultimately determine whether a borrower is approved for a Main Street loan in light of these considerations. Accordingly, businesses that otherwise meet the Main Street Program borrower eligibility requirements may not be approved for a loan or may not receive the maximum allowable amount.

Disclosure

The Fed will disclose information regarding the Main Street loans during the operation of Main Street Program, including information regarding names of lenders and borrowers, amounts borrowed and interest rates charged, and overall costs, revenues and other fees. Under section 11(s) of the Federal Reserve Act, the Fed also will disclose information concerning the Main Street Program one year after the effective date of the termination of the authorization of the Main Street Program. This disclosure will include names and identifying details of each participant in the Main Street Program, the amount borrowed, the interest rate or discount paid, and information concerning the types and amounts of collateral pledged or assets transferred in connection with participation in the Main Street Program.

Documentation and Launch Date

The Fed has announced that it will publicly issue a form loan participation agreement, form borrower and lender certifications, and other form agreements that are necessary to implement the Main Street Program in accordance with the term sheets. The Fed, however, will not provide form loan documents for eligible lenders to use when making eligible loans to eligible borrowers—and eligible lenders are advised that they should provide these documents, which are to reflect the terms of Main Street Program established by the Fed.

Updates regarding the Main Street Program, including the official launch date, and the time and date at/on which the Fed will begin purchasing participations in Main Street loans, will be made available on the Fed’s website.

Changes to Main Street Lending Program and Terms

The Board of Governors of the Federal Reserve System and the Secretary of the Treasury may make adjustments to the terms and conditions of the Main Street Program and will announce any changes on the Fed’s website.

Before applying for a Main Street loan, borrowers should review existing credit agreements, governing documents and other contracts to identify any restrictions on the incurrence of additional indebtedness.

Seyfarth is actively monitoring all aspects of federal COVID-19 business stimulus funding legislation and guidance impacting our clients. Visit our Resource Center for more information.

1 13 CFR 121.301(f)

2 Of note, the Fed specified that this and the preceding requirement will not prohibit a borrower from undertaking any of the following actions during the term of the Main Street Loan:

- repaying a line of credit (including a credit card) in accordance with the borrower’s normal course of business usage for such line of credit;

- taking on and paying additional debt obligations required in the normal course of business and on standard terms, including inventory and equipment financing, provided that such debt is secured by newly acquired property (e.g., inventory or equipment), and, apart from such security, is of equal or lower priority than the Main Street Loan; or

- refinancing maturing debt.