Among many key topics covered in Seyfarth’s 10th annual Real Estate Market Sentiment Survey, CRE executives weigh in on their top concerns, investment priorities, and other catalysts for change. Read on for key highlights, or download the full survey now.

Unwavering Optimism

CRE executive optimism reached a five-year high, with 87 percent confident about the year ahead.

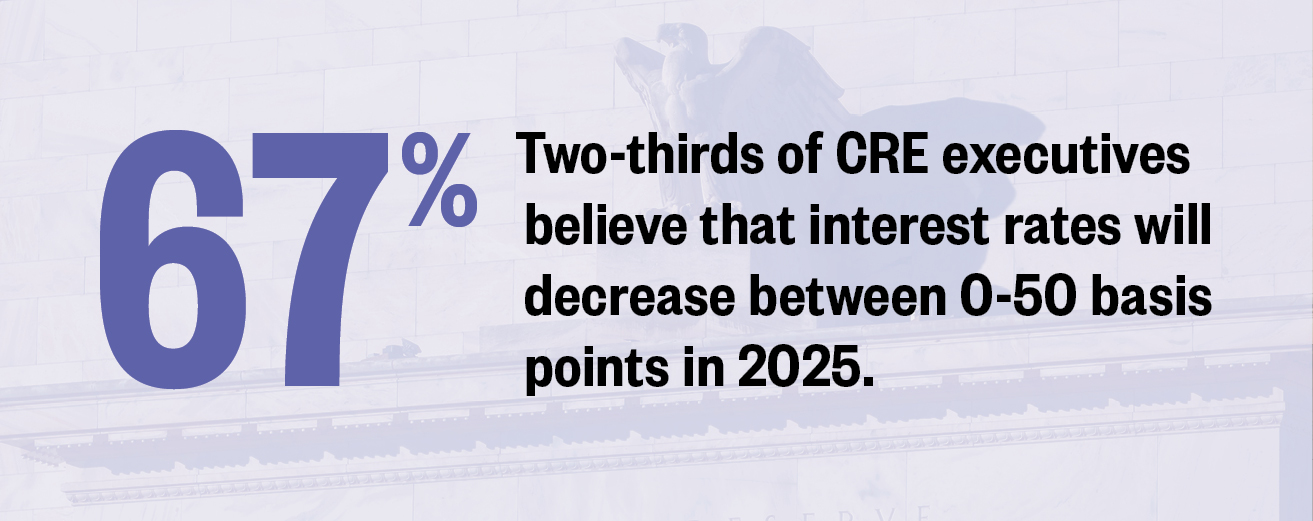

Rate Realism

The significant rate cuts anticipated last year failed to materialize. In 2025, two-thirds of CRE executives believe that interest rates will decrease between 0-50 basis points. Only 10 percent of respondents believe that interest rates will decrease more than 50 basis points.

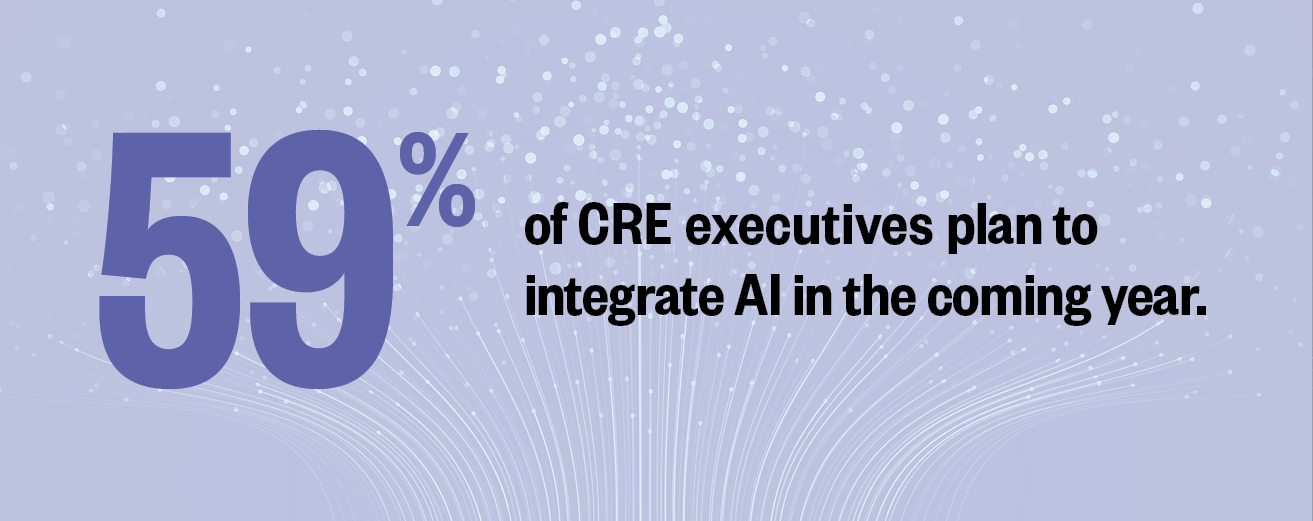

AI Aspirations

In 2024, 34 percent of respondents planned to adopt AI capabilities, and by 2025, 33 percent had followed through—closely aligning with expectations. Looking ahead, the CRE market is accelerating its tech adoption, with 59 percent planning to integrate AI in the coming year.

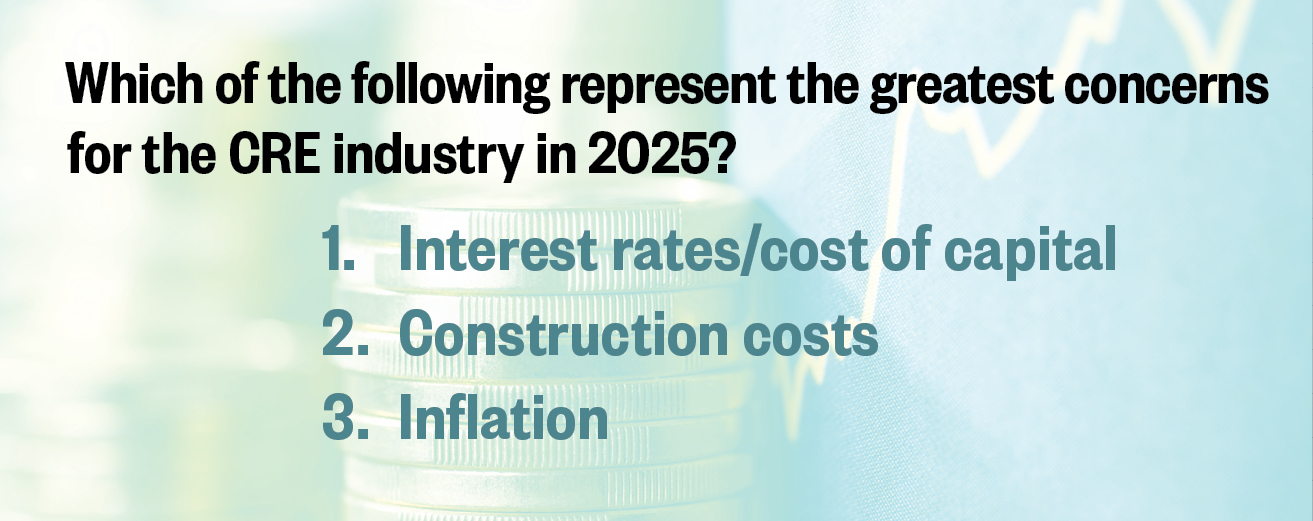

Mounting Concerns

Rising costs and market uncertainties dominate the minds of CRE executives heading into 2025. Interest rates remain the most pressing worry, with 83 percent identifying them as a key challenge, up from 70 percent last year. Concerns about construction costs have also climbed to 45 percent, and inflation continues to weigh heavily, with 43 percent of executives highlighting it as a major issue. The availability and affordability of property insurance is emerging as a significant concern.

Past Surveys

2025 marks the 10th year of our Real Estate Market Sentiment Survey. Download past surveys via the links below.